Could the UK Self-Build Out of the Housing Crisis?

Most people would agree that the United Kingdom has a vastly inflated housing market, leaving most of Generations Y and Z with no hope of home ownership other than by inheritance. This perpetuates inequality and reduces social mobility (Joseph Rowntree Foundation, 2020). Gen X-ers who got off the ladder at the wrong time, can also be locked out of stability just as they look towards retirement. There is a lot of talk of building new houses and “affordable” schemes at a national and local level, but one way or another they all involve either additional debt facilities, or a token allocation in exchange for relaxed planning regulations. British homes are the smallest and most expensive in Europe. Few commentators really dig into the “why”.

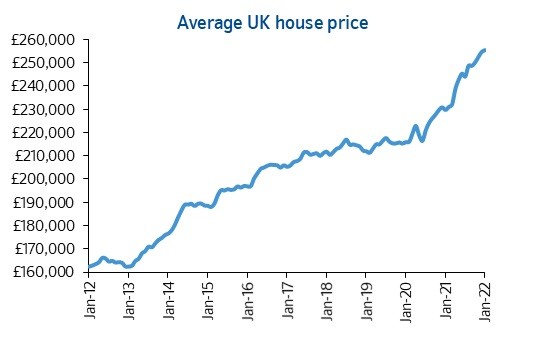

Unreachable house prices have been sustained by a perfect storm of demographics, fiscal policy and housing policy, in which all major political parties have taken their part:

- A population growth of over ten per cent since the turn of the millennium: whether through freedom of movement while in the EU, or issuance of work visas, all governments have encouraged working-age migration to the UK to promote economic growth - even those preaching an anti-immigration rhetoric! (Vargas-Silva, 2019)

- A generation of artificially low interest rates: a Conservative inflation target in 1992 was based on RPI(X), excluding mortgage interest payments for the first time - designed to avoid a repeat of the 1989 property crash. In 2003, a Labour Chancellor told the Treasury to target the consumer prices index instead - an internationally agreed measure that goes further, excluding all owner-occupied housing costs (Elliott, 2016). In short, house prices would no longer be considered inflationary, and could not lead to a rise in interest rates. For forty years, all governments have allowed unchecked housing inflation, out of touch with average earnings. The fear of alienating the middle class home owners, who have a high tendency to vote, has paralysed any serious policy analysis that might conclude a correction in the market is necessary.

- Lack of social housing. The Government spends £25 billion – 3% of the entire budget - on housing benefit to private landlords every year (Johnson, 2019) . Meanwhile only half as many people are now in social housing compared to the early 1980s, and only half of those again are in local authority housing. The remainder is provided by private trusts. (Adam et al, 2015) In effect, successive governments have moved from investing in social housing, to subsidising the buy-to-let boom.

As part of a study on Universal Basic Services, I compared housing policy in the UK with perhaps an unlikely analogue in the Sultanate of Oman. Oman is roughly the same land area as the UK, but sparsely populated in comparison and with great differences of culture, economy and geography. There were other reasons for choosing Oman for the study, but the housing analysis threw up some interesting comparisons. As a starting point, there are some basic similarities:. People aspire to own houses. Prices of new properties or building plots can be unaffordable for ordinary working people. And, there is not always a sufficient supply of suitable family housing.

Oman's housing provision is markedly different in both approach and effect: 91% of Omanis live in their own homes. (Times of Oman, 2021). The Government achieve this level by giving away building plots with outline planning permission: almost 450,000 building plots have been allocated since 2011. (Times of Oman, 2019). For context, the estimated number of Omani households in 2019 was c.305,000 (NCSI, 2021). The state-owned Oman Housing Bank (OHB) can provide loans to buy or build a home: up to a realistic £150,000 or so, and at favourable rates - from market average for average earners, down to as little as 1% for the lowest earners, and with only a nominal deposit. It is worth noting that OHB makes an operating profit even with these generous terms. (OHB, 2020)

This process is much simpler when undeveloped, non-agricultural land is generally owned by the state. But, although more densely populated, there is evidence that the UK also has plenty of suitable room to build more houses. A report by the Council for the Protection of Rural England (CPRE) claims that there is available brownfield land (land that is previously built on but now unused or derelict) for the construction of over one million new homes (CPRE, 2020). The same study claims that much of this land is already owned by central or local government.

So, what could a British land allocation programme look like? In the spirit of Universal Basic Services, those decisions have to be local and community based. Councils could hold their own citizens' assemblies to advise on needs and priorities, even approved architectural styles. “Responsive, effective and accountable local government – with financial autonomy – will be necessary for the practical implementation” (Percy et al, 2017).

Subject to local community agreement, development plots could be allocated to individuals for self-build, starting a revolution in modern housing. Rather than creating urban sprawl and energy demands, free land could be accompanied by a whole new set of higher building energy standards, for insulation, low-impact materials and energy self-sufficiency through solar and even shared wind energy. As it would take place on existing brownfield sites, the opportunity is there for environmental restoration, rather than degradation. Take a look at the Olympic Park in east London for some hints at how this can look (but with fewer velodromes and more houses...) Both central and local government bodies could devise exemplary environmental criteria for these new homes: first for the brownfield allocations, as trials, and eventually promulgate the proved successes as national standards. This would address a major share of the UK's climate change responsibilities: home energy use represents 29% of final energy consumption in the UK (Hefferman et al, 2020).

Initiatives like the “tiny house” movement could also have their own space, especially for the young and single who currently find it almost impossible to find social housing. Elsewhere, standards for family housing could be raised, instead of shrunken to fit ever more tightly by the needs of commercial developers to squeeze as many units onto a site as possible. For those intimidated by self-build, private developers could be invited to give fixed cost turn-key packages for certain zones, to approved semi-bespoke designs. This is not communism, regulated capitalism would be a key driver and the only way to make development viable. And of course, zoning and designing all these sites may inspire local authorities to invest once more in their own social housing. - perhaps.

The overall economic effect could be profound: a million homes to be built, a million customers waiting and ready to pay. Architects, designers, every sustainable home-building technology and product would receive an enduring boost. The 55% of working people currently in need of benefits to make ends meet, could be prioritised and liberated (Joseph Rowntree Foundation, 2020). Some of those in a benefit trap would find a new incentive to take even the smallest marginal benefit of paid employment, in order to be eligible for a plot and a loan. A whole section of the population may be able to provide for themselves and their families when freed from the burden of private rent – the most expensive form of housing (Cribb, 2018). If sufficient sites can be found, the pressure on social housing may also be eased, allowing the most needy to move out of temporary solutions and into dignified living.

But what would happen to the housing market if, over the next few years, a million people were able to take an affordable loan to build their own home on an allocated piece of brownfield land? It is worth noting that the Omani housing market remains strong, with premium land plots (not houses!) in the capital selling for a million pounds (OLX, 2021). The ubiquitous availability of housing has destroyed neither social aspiration, nor the market. It is fair to assume that the availability of a little plot on top of an old provincial power station is not going to crush the desire for a detached riverside property in the London commuter belt.

The British tax payer still owns the largest share of a major bank (Royal Bank of Scotland/Natwest Group). Instead of complete divestment, taking just part of that portfolio into full ownership on the OHB model would be constructive, literally. OHB's low interest rates and profitability have not affected the success of other banks. Like OHB, a British Housing Bank would only be serving a section of the community, and one less attractive to commercial banks. As even a low-interest housing bank can be profitable, some earnings for the tax payer would offset part of the administrative cost. In a few short years, the savings in housing benefits for working families in private rentals – an average of £5000 per annum – could amount to much more (Johnson, 2019).

The inevitable slowness of rolling out such a programme would allow a fairly gentle softening of the property and buy-to-let markets. No negative equity, no evictions, and no lost votes. No politician in the UK is going to campaign at an election on a platform of raising interest rates and crashing the housing market. But by making better use of brownfield sites, and a radical approach to self-building and local projects, they might be able to finally solve the housing problem after all.

References:

Adam, S., Chandler, D, Hood, A.and Joyce,R, 2015, Social Housing in England: A Survey, Institute for Fiscal Studies, November 2015

AGCC Statistics https://www.gccstat.org/en/country-profile/, accessed 18 July 2021

Bromley, C. (2003) ‘Has Britain become immune to inequality?’, in A. Park, J. Curtice, K. Thomson, L. Jarvis and C. Bromley (eds) British Social Attitudes 20th Report: Continuity and Change over Two Decades. London: Sage

CPRE, 2020, Recycling our land: the state of brownfield 2020

Cribb, J., Norris Keiller, A. and Waters, T., 2018. Living standards, poverty and inequality in the UK: 2018 (No. R145). IFS Report.

Elliott, L, (2007), “RPI Equals TPI but not CPI”, The Guardian, 16 May 2007, https://www.theguardian.com/money/2007/may/16/consumernews, accessed 26 Septemer 2021

Heffernan, E. and De Wilde, P., 2020. Group self-build housing: A bottom-up approach to environmentally and socially sustainable housing. Journal of Cleaner Production, 243, p.118657.

Joseph Rowntree Foundation (2020) UK Poverty 2019/20, www.jrf.org.uk/report/uk-poverty-2019-20, accessed 15 September 2021

Johnson, P, 2019,Doubling of the housing benefit bill is sign of something deeply wrong, “The Times”, 4 March 2019

National Centre for Statistical Information (NCSI), Sultanate of Oman, https://data.gov.om/, accessed 16 August 2021

OBR, 2017,” An OBR guide to welfare spending”, https://obr.uk/forecasts-in-depth/brief-guides-and-explainers/an-obr-guide-to-welfare-spending/, accessed 21 July 2021

OLX, 2021, https://www.olx.com.om/en/properties/properties-for-sale/land-for-sale, accessed on 30 August 2021

Oman Housing Bank (OHB), 2021, https://ohb.co.om, accessed 27 August 2021

Oman Portal, 2021, https://www.oman.om/wps/portal/index/cr/housing/housingloans, accessed 24 August 2021

Percy, A., Portes, J. and Reed, H, 2017. Social prosperity for the future: A proposal for Universal Basic Services.

Times of Oman, 2021, https://timesofoman.com/article/97576-more-than-90-of-families-in-oman-have-their-own-housesm accessed 20 August 2021

Vargas-Silva, C. and Rienzo, C., 2019. Migrants in the UK: an overview. Briefing Paper: Migration Observatory, University of Oxford.

Director - Delamere Global Advisory

1yGood read Sir! Has to be worth a try as a fix for a broken system.

Manager Accounts

1yGreat Alexander